PLG NEWSNews + updates + recent press

|

Archives

June 2024

May 2024

March 2024

February 2024

August 2023

May 2023

April 2023

January 2023

November 2022

September 2022

August 2022

June 2022

April 2022

March 2022

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

October 2020

September 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

August 2019

June 2019

May 2019

April 2019

February 2019

January 2019

November 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

March 2018

January 2018

December 2017

October 2017

September 2017

August 2017

July 2017

|

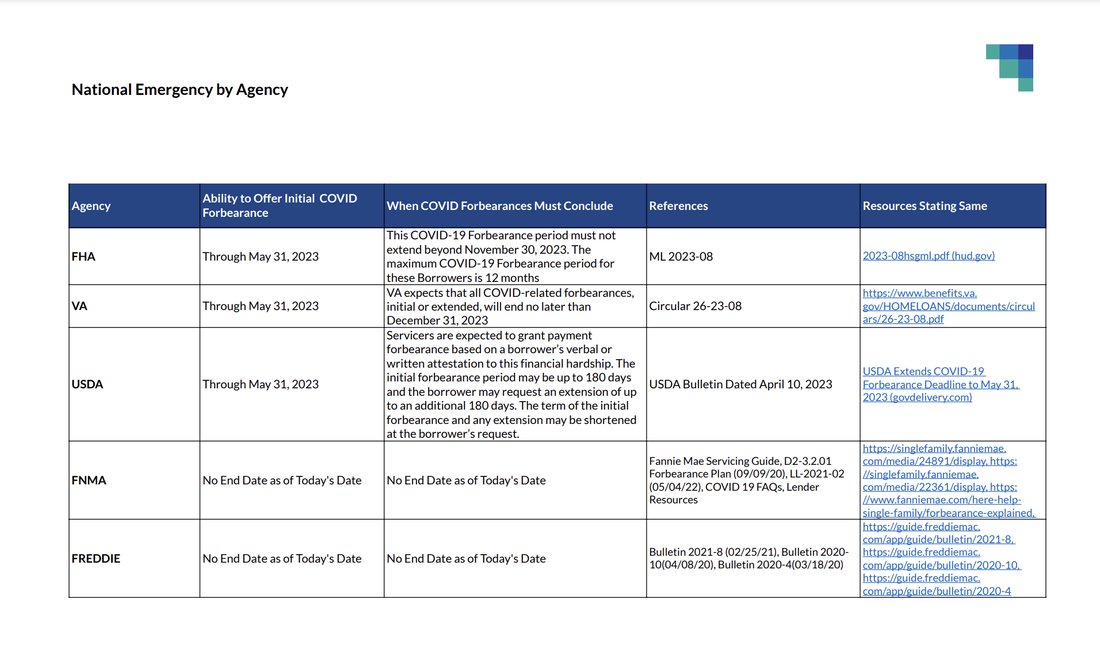

The United States Senate passed a resolution to end the National Emergency for COVID-19 on March 29, 2023, and the President signed it on Monday, April 10, ending the emergency earlier than May 11, 2023 as previously announced. Now that the National Emergency has ended, it is important to understand the implications for servicing, default, and loss mitigation. Below outlines the significance behind the ending of the National Emergency. This post includes Agency-specific updates covering:

Additional Loss Mitigation ResourcesREG X UPDATE Regulation X Impact: Streamlined Loss Mitigation Options12 CFR 1024.4(c)(2)(v)(vi) Certain COVID-19 Related Loss Mitigation Options: Current COVID Exemption: Under the current regulation, Servicers were able to offer a borrower a loss mitigation option based upon the evaluation of an incomplete application, if “borrowers were experiencing a COVID-19 related hardship, including a payment forbearance program made pursuant to the Coronavirus Economic Stabilization Act, section 4022 (15 U.S.C. 9056); it also includes, without limitation, all other principal and interest payments that are due and unpaid by a borrower experiencing COVID-19 related hardship.” The definition of COVID-19 related hardship per 12 CFR 1024.31 means: “a financial hardship due, directly or indirectly, to the national emergency for the COVID-19 pandemic declared in Proclamation 9994 on March 13, 2020 (beginning on March 1, 2020) and continued on February 24, 2021, in accordance with section 202(d) of the National Emergencies Act (50 U.S.C.1622(d)).” Now that the National Emergency has ended: As the National Emergency has now ended, it could be argued that the streamlined loss mitigation option, allowing Servicers to offer a loss mitigation option based upon an incomplete application is no longer applicable as the definition stated the hardship was connected to the National Emergency. Note, on January 18, 2023, when the Bureau released the updates to Mortgage Servicing Exam Procedures they did state in their blog post that, “we understand these streamlined options have been very successful in keeping consumers in their homes, and note that COVID-19 will continue to impact families, even beyond the national emergency. We also note that as long as these streamlined loss mitigation options are made available to borrowers experiencing hardship due to the COVID-19 national emergency, those same streamlined options can also be made available under the temporary flexibilities in the rule to borrowers not experiencing COVID-19-related hardships. We expect servicers to continue to utilize all the tools at their disposal—including, if available, streamlined deferrals and modifications that meet the conditions of the CFPB’s COVID-19 related mortgage servicing rules—in their efforts to keep consumers in their homes.” It is important to note that Regulation X does not define what a complete loss mitigation package is when reviewing Borrowers. See 12 CFR 1024.41(b) it does not define what a complete loss mitigation package is, rather that is for the Servicer to decide what a complete package is. Per 12 CFR 1024.41(b)(1) comment, it states “a servicer has flexibility to establish its own application requirements and to decide the type and amount of information it will require from borrowers applying for loss mitigation options. In the course of gathering documents and information from a borrower to complete a loss mitigation application, a servicer may stop collecting documents and information for a particular loss mitigation option after receiving information confirming that, pursuant to any requirements established by the owner or assignee of the borrower's mortgage loan, the borrower is ineligible for that option. FHA UPDATE FHA Insured Loans Impacted: COVID-19 Forbearances may be offered through May 31, 2023Per Mortgagee Letter 2023-03: COVID-19 Recovery Options may be offered through, but no later than October 30, 2024, and completed no later than, February 27, 2025.” This means that the below COVID-19 loss mitigation options are still available even with the National Emergency no longer in effect:

Impact of the National Emergency Ending Per Mortgagee Letter 2023-08, Borrowers may request an initial forbearance through May 31, 2023. Previously, the language stated through the end of the National Emergency. Additionally, FHA updated the language surrounding the time period COVID-19 Forbearances may be effective through until November 30, 2023. Previously, the language stated six months after the National Emergency ends. VA UPDATES VA Insured Loans ImpactForbearances: Per Circular 26-23-8 (04/21/23): “For borrowers who have not received a COVID-related forbearance as of the date of this Circular, servicers should allow such borrowers to receive a COVID-related forbearance if the borrower makes the request on or before May 31, 2023. VA is providing additional time for borrowers to request a COVID-related forbearance beyond the April 10, 2023, end date of the National Emergency. VA expects that all COVID-related forbearances, initial or extended, will end no later than December 31, 2023. Loan Deferment: Per Circular 26-20-33 (09/14/20): “On March 27, 2020, the President signed into law the Coronavirus Aid, Relief, and Economic Security Act (the CARES Act), Public Law 116-136. Section 4022 of the CARES Act protects borrowers with Federally backed mortgage loans who are experiencing financial hardship due to the COVID-19 national emergency. In VA Circular 26-20-12, Extended Relief Under the CARES Act for those Affected by COVID-19, VA noted that servicers should consider all loss mitigation options described by Chapter 5 of the VA Servicer Handbook M26-4 (including those related to disasters) in determining how to account for payments that were subject to a CARES Act forbearance. VA also outlined that servicers are not to require a borrower who receives a CARES Act forbearance to make a lump sum payment, equating to what would have been due if a forbearance was not in effect, after the forbearance period ends.” “This temporary waiver applies only in the case of a servicer offering a deferment as a COVID-19 loss mitigation option to a borrower who requested a CARES Act forbearance, as described above. Furthermore, VA notes that the servicer must ensure that deferment will not adversely affect the Government’s interests in the VA-guaranteed loan and/or impair the vested rights of any other person. See 38 C.F.R. § 36.4338(a). Similarly, any deferment that fails to comply with other servicing laws, such as the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA), would negatively affect the Government’s interest and therefore not be covered by this temporary suspension.” Now that the National Emergency has ended for Loan Deferments: They expire as of July 1, 2023 per Circular 26-20-10, Change 3 (March 2022) COVID-19 Refund Modifications: Per Circular 26-21-13 (July 23, 2021), the Circular is rescinded as of July 1, 2023 VA Disaster Extend Modifications: Per Circular 26-21-07, “with this Circular, VA is clarifying that a servicer can enter into a VA Disaster Modification if the modification is made not later than the date that is 18 months after the date on which the COVID-19 national emergency ends without VA pre-approval. Additionally, a servicer can offer a VA Disaster Modification regardless of whether the borrower has entered into a COVID-19 forbearance plan and regardless of whether the COVID-19 national emergency caused the default. VA is allowing for Disaster Extend Modifications to extend the loan’s original maturity date for up to 18 months, in cases where the loan is modified not later than the date that is 18 months after the date on which the COVID-19 national emergency ends. VA does not normally allow for Disaster Extend Modifications to extend the loan’s maturity date more than 12 months beyond the original maturity date without VA pre-approval. The servicer can offer a Disaster Extend Modification regardless of whether the borrower has entered into a COVID-19 forbearance plan and regardless of whether the COVID-19 national emergency caused the default.” Expiration Date: Per Circular26-21-07, Change 2 (February 28, 2022): Expires July 1, 2023 GNMA UPDATES Impact on GNMA Requirements: Most of the COVID APMs will most likely expire Summer 2023APM 23-02- Extension of Temporary Relief from the Acceptable Delinquency Threshold Requirement APM The exemptions that were originally announced in APM 20-06: “Treatment of Mortgage Delinquency Ratios for Issuers Affected by COVID-19", and most recently extended in APM 22-05: “Extension of Temporary Relief from the Acceptable Delinquency Threshold Requirement”, from January 31, 2023 (December 2022 investor reporting) to July 31, 2023 (June 2023 investor reporting). When does it expire: Ginnie Mae will continue to exclude any delinquencies occurring on or after April 2020 for the purposes of enforcing the provisions in Ch. 18, Part 3, §§ C & D. Ginnie Mae will provide this exclusion automatically through July 31, 2023, to Issuers that were compliant with Ginnie Mae’s delinquency rate thresholds as demonstrated by their April 2020 investor accounting report, reflecting March 2020 servicing data. Originally, APM 20-06 stated “the exemptions and delinquent loan exclusions implemented by this memorandum will automatically expire on December 31, 2020 (November 2020 investor reporting) unless rescinded earlier or extended by Ginnie Mae, or the end of the National Emergency, whichever comes earlier.” APM 22-01- Streamlined Documentation Requirements for FHA Advance Loan Modifications: “The streamlined documentation requirements for ALM loans will sunset with June 1, 2023 pool issuances. ALMs in pool issuances on or after July 1, 2023, must meet Ginnie Mae’s standard requirements for recording and title insurance.” ML 2023-03: “Borrowers who are 90 or more Days delinquent and not on a COVID-19 Forbearance must be considered for a COVID-19 ALM through October 30, 2024.” Conflict: APM only allows for the streamlined documentation through June 1, 2023, while the ML states through October 30, 2024. APM 23-01: Extension of Permitting Alternative Procedures for Certain Aspects of Issuer Annual Audit Report: “Due to the continuing impact of the COVID-19 Pandemic National Emergency, Ginnie Mae is extending the use of alternative audit procedures originally announced in APM 20-14: “Alternative Procedures Permitted for Certain Aspects of Issuer Annual Audit Report for Fiscal Year 2020”, APM 21-08: “Extension of Permitting Alternative Procedures for Certain Aspects of Issuer Annual Audit Report, and most recently extended in the APM 22-06: “Extension of Permitting Alternative Procedures for Certain Aspects of Issuer Annual Audit Report” for Issuers with a fiscal year ending on or before June 30, 2023.” Expiration: Ginnie Mae will accept audited financial statements and Audit Reports for Issuers with a fiscal year ending on or before June 30, 2023, where the independent auditor relied on alternative procedures to meet the Issuer’s document custodian annual audited financial statement and Audit Report review objectives in lieu of the procedures outlined in the HUD Audit Guide, which would otherwise require physical inspection and observation. USDA UPDATES USDA Single Family Housing Guaranteed Loan ProgramImpact of National Emergency Ending Servicers are authorized to approve initial payment forbearances upon request for borrowers impacted by the COVID-19 National Emergency until May 31, 2023. Per the Bulletin released on April 10, 2023: “To provide relief to impacted borrowers, servicers are authorized to approve initial payment forbearances upon request for borrowers impacted by the COVID-19 National Emergency until May 31, 2023. Servicers are expected to grant payment forbearance based on a borrower’s verbal or written attestation to this financial hardship. The initial forbearance period may be up to 180 days and the borrower may request an extension of up to an additional 180 days. Upon completion of the COVID-19 forbearance the servicer should work with the borrower to provide a solution to cure the arrearage and resume making monthly payments. The servicer must evaluate the borrower for USDA Special Relief Alternatives and/or COVID-19 Special Relief Alternatives that are outlined in Chapter 18 of the Handbook-1-3555.” COVID–19 Special Relief Measures: The servicer should establish a target payment that includes up to a twenty (20) percent payment reduction from the borrower’s current principal and interest payment. Once the target payment is established, the servicer should incrementally utilize the following options to get as close to the target payment as possible.

Homeowner Assistance Funds Impact: None. Per the American Rescue Plan Act Section 3206, “the Homeowner Assistance Fund shall be in effect until the funds run out or until September 30, 2025, whichever comes first.” Credit Reporting under the FCRA under Section 4201 of the Cares Act 2020: Requirements expire 120 days after the declaration that the National Emergency has ended per Section 4201, Covered Period. Beginning on January 31, 2020 and ending on the later of:

Questions about this post?This post was prepared by Marissa M. Yaker, Esq. Contact us here.

Please note that this information is current as of the dissemination hereof. All information is subject to change without notice. This is being provided as a courtesy only and does not constitute legal advice and is general in nature and not applicable to any particular loan or scenario. The reader is encouraged to check the Agency publications and websites frequently to obtain the most recent information and guidance and to consult an attorney with jurisdiction-specific questions as to application. This note applies to any resources, attachments, downloads, webinars or other content made available by this website. For full terms of use please refer to our privacy policy and disclaimer accessed via this link. Comments are closed.

|

PLG BLOG DISCLAIMER

The information contained on this blog shall not constitute legal advice or a legal opinion. The existence of or review and/or use of this blog or any information hereon does not and is not intended to create an attorney-client relationship. Further, no information on this blog should be construed as investment advice. Independent legal and financial advice should be sought before using any information obtained from this blog. It is important to note that the cases are subject to change with future court decisions or other changes in the law. For the most up-to-date information, please contact Padgett Law Group (“PLG”). PLG shall have no liability whatsoever to any user of this blog or any information contained hereon, for any claim(s) related in any way to the use of this blog. Users hereby release and hold harmless PLG of and from any and all liability for any claim(s), whether based in contract or in tort, including, but not limited to, claims for lost profits or consequential, exemplary, incidental, indirect, special, or punitive damages arising from or related to their use of the information contained on this blog or their inability to use this blog. This Blog is provided on an "as is" basis without warranties of any kind, either express or implied, including, but not limited to, warranties of title or implied warranties of merchantability or fitness for a particular purpose. |

|

Padgett Law Group and Padgett Law Group EP are D/B/As of Timothy D. Padgett, P.A. Timothy D. Padgett, P.A.'s practice areas include creditors' rights, estate planning and probate, real estate transactions and litigation. Not all practices or services are available in all states in which Timothy D. Padgett, P.A. practices.

PRIVACY STATEMENT | WEBSITE DESIGN BY SQFT.MANAGEMENT

|