PLG NEWSNews + updates + recent press

|

Archives

June 2024

May 2024

March 2024

February 2024

August 2023

May 2023

April 2023

January 2023

November 2022

September 2022

August 2022

June 2022

April 2022

March 2022

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

October 2020

September 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

August 2019

June 2019

May 2019

April 2019

February 2019

January 2019

November 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

March 2018

January 2018

December 2017

October 2017

September 2017

August 2017

July 2017

|

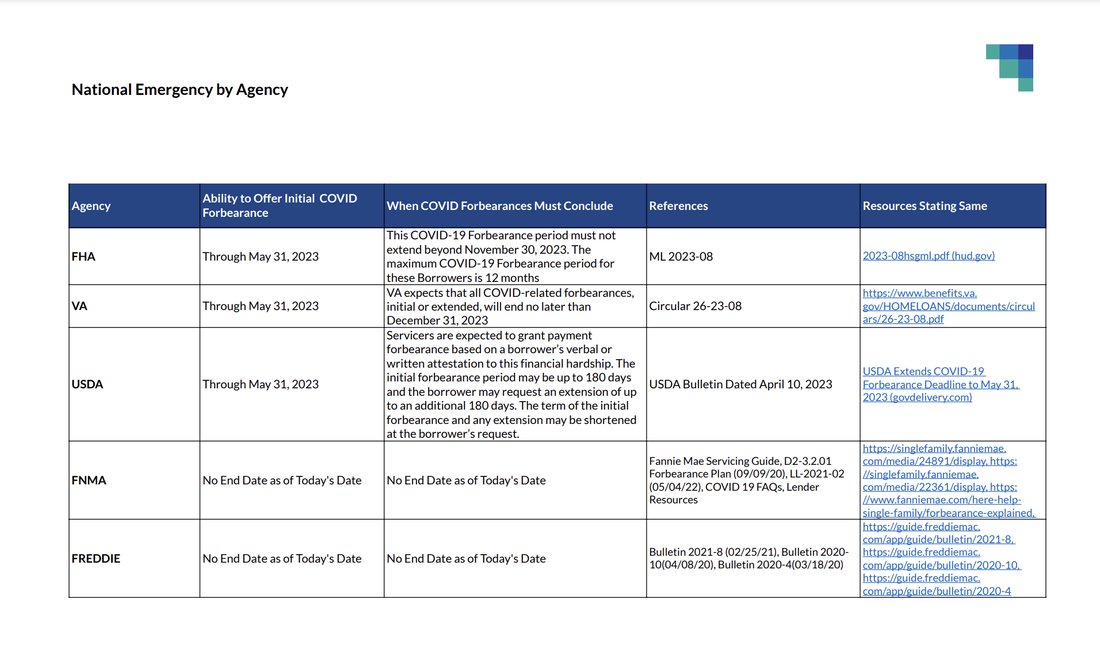

The United States Senate passed a resolution to end the National Emergency for COVID-19 on March 29, 2023, and the President signed it on Monday, April 10, ending the emergency earlier than May 11, 2023 as previously announced. Now that the National Emergency has ended, it is important to understand the implications for servicing, default, and loss mitigation. Below outlines the significance behind the ending of the National Emergency. This post includes Agency-specific updates covering:

Additional Loss Mitigation ResourcesPANDIFFERENT, the Padgett Web Summit, was recognized today as part of the 2021 Apex Communications Awards. PANDIFFERENT won an Award of Excellence for COVID-19 Media in the Education & Training Category. The Apex Awards is an annual competition held by Communications Concepts, which has been conducting the Awards for 33 years. PANDIFFERENT, launched in October 2020, is an online education event for clients and employees of Padgett Law Group (PLG). The format, unique to virtual summits in the industry, includes ten pre-recorded sessions featuring a mix of PLG leaders, clients, and industry guests, followed by a closing super session with select panelists from the day’s recordings rejoining for a live closing. Over 500 mortgage servicing professionals registered for and participated in PANDIFFERENT 2020. Topics covered major foreclosure, bankruptcy, and litigation trends and other topics important to PLG, including diversity, inclusion, and equity. Leaders from across the industry joined various panels, including senior executives from U.S. Bank, Community Loan Servicing, a360inc, Five Star Global, American Legal & Financial Network, and more. “2020 required us to do everything differently and that included reimagining how we trained our staff clients, which traditionally was onsite and in small groups. The PANDIFFERENT concept allowed us to reach a much larger audience, cover more timely topics, and deliver an innovative product to PLG clients that no other firm in our industry can offer,” said Chief Development Officer Robyn Padgett. PANDIFFERENT: The Padgett Web Summit returns October 1, 2021 and registration opens Thursday, July 15 at PadgettLawGroup.com. Registration is complimentary for employees of lenders, mortgage servicers, credit unions, banks, hedge funds, investors, other financial institutions, government agencies, and local, state, and federal housing authorities. All others may request an invitation by contacting [email protected]. FHFA announced that Fannie Mae and Freddie Mac (the Enterprises) are extending the moratoriums on single-family foreclosures and real estate owned (REO) evictions until June 30, 2021. The foreclosure moratorium applies to Enterprise-backed, single-family mortgages only. The REO eviction moratorium applies to properties that have been acquired by an Enterprise through foreclosure or deed-in-lieu of foreclosure transactions. The current moratoriums were set to expire on March 31, 2021. FHFA also announced that borrowers with a mortgage backed by Fannie Mae or Freddie Mac may be eligible for an additional three-month extension of COVID-19 forbearance. This additional three-month extension allows borrowers to be in forbearance for up to 18 months. Eligibility for the extension is limited to borrowers who are in a COVID-19 forbearance plan as of February 28, 2021, and other limits may apply. Further, COVID-19 Payment Deferral for borrowers with an Enterprise-backed mortgage can now cover up to 18 months of missed payments. COVID-19 Payment Deferral allows borrowers to repay their missed payments at the time the home is sold, refinanced, or at mortgage maturity. FHFA Extends Foreclosure and REO Evictions Moratoriums and COVID Forbearance Period. Borrowers can now be in COVID forbearance for up to 15 months Washington, D.C. – Today, the Federal Housing Finance Agency (FHFA) announced that Fannie Mae and Freddie Mac (the Enterprises) are extending the moratoriums on single-family foreclosures and real estate owned (REO) evictions until March 31, 2021. The foreclosure moratorium applies to Enterprise-backed, single-family mortgages only. The REO eviction moratorium applies to properties that have been acquired by an Enterprise through foreclosure or deed-in-lieu of foreclosure transactions. The current moratoriums were set to expire on February 28, 2021. FHFA also announced that borrowers with a mortgage backed by Fannie Mae or Freddie Mac may be eligible for an additional forbearance extension of up to three months. Eligibility for the extension is limited to borrowers who are on a COVID-19 forbearance plan as of February 28, 2021, and other limits may apply. Further, COVID-19 Payment Deferral for borrowers with an Enterprise-backed mortgage can now cover up to 15 months of missed payments. COVID-19 Payment Deferral allows those borrowers to repay their missed payments at the time the home is sold, refinanced, or at mortgage maturity. “To keep families in their home during the pandemic, FHFA is allowing borrowers to be in COVID-19 forbearance for up to 15 months and extending the Enterprises' foreclosure and eviction extension," said Director Mark Calabria. Currently, FHFA projects expenses of $1.5 to $2 billion will be borne by the Enterprises due to the existing COVID-19 foreclosure moratorium and its extension. FHFA continues to monitor the effect of the COVID-19 servicing policies on borrowers, the Enterprises and their counterparties, and the mortgage market. FHFA may extend or sunset its policies based on the data and the health risk. The Federal Housing Finance Agency regulates Fannie Mae, Freddie Mac and the 11 Federal Home Loan Banks. These government-sponsored enterprises provide more than $6.7 trillion in funding for the U.S. mortgage markets and financial institutions. Additional information is available at www.FHFA.gov, on Twitter, @FHFA, YouTube, Facebook, and LinkedIn. Title insurance is a very important part of the REO transaction. Originally resulting because of the CARES Act passed last March, several national title insurance companies issued bulletins to their agents regarding their various positions on what is needed for them to insure properties related to foreclosures. This led to the title insurance companies placing additional requirements and restrictions in order for them to insure properties at REO following a foreclosure that was conducted while the Act was in place. Although the Act itself has expired, the moratoriums are still in place and have been recently extended (again). The national title insurance companies have expanded their bulletins to include the same or similar requirements for foreclosures occurring during the moratoriums going into this year. At least one national title insurance company has taken a very conservative approach and will not insure any property related to a foreclosure action during the moratoriums, whether the property is vacant or abandoned. These restrictions will apply to loans involving HUD, VA, Fannie Mae, Freddie Mac, or USDA. |

PLG BLOG DISCLAIMER

The information contained on this blog shall not constitute legal advice or a legal opinion. The existence of or review and/or use of this blog or any information hereon does not and is not intended to create an attorney-client relationship. Further, no information on this blog should be construed as investment advice. Independent legal and financial advice should be sought before using any information obtained from this blog. It is important to note that the cases are subject to change with future court decisions or other changes in the law. For the most up-to-date information, please contact Padgett Law Group (“PLG”). PLG shall have no liability whatsoever to any user of this blog or any information contained hereon, for any claim(s) related in any way to the use of this blog. Users hereby release and hold harmless PLG of and from any and all liability for any claim(s), whether based in contract or in tort, including, but not limited to, claims for lost profits or consequential, exemplary, incidental, indirect, special, or punitive damages arising from or related to their use of the information contained on this blog or their inability to use this blog. This Blog is provided on an "as is" basis without warranties of any kind, either express or implied, including, but not limited to, warranties of title or implied warranties of merchantability or fitness for a particular purpose. |

|

Padgett Law Group and Padgett Law Group EP are D/B/As of Timothy D. Padgett, P.A. Timothy D. Padgett, P.A.'s practice areas include creditors' rights, estate planning and probate, real estate transactions and litigation. Not all practices or services are available in all states in which Timothy D. Padgett, P.A. practices.

PRIVACY STATEMENT | WEBSITE DESIGN BY SQFT.MANAGEMENT

|