PLG NEWSNews + updates + recent press

|

Archives

June 2024

May 2024

March 2024

February 2024

August 2023

May 2023

April 2023

January 2023

November 2022

September 2022

August 2022

June 2022

April 2022

March 2022

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

October 2020

September 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

August 2019

June 2019

May 2019

April 2019

February 2019

January 2019

November 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

March 2018

January 2018

December 2017

October 2017

September 2017

August 2017

July 2017

|

The Supreme Court of Texas, in PNC Mortgage v. Howard, recently held that the holder of a deed of trust was entitled to foreclose through equitable subrogation, even after the four-year foreclosure statute of limitations had lapsed. Click here to read the opinion. In 2003, the borrowers purchased a home with loans secured by two purchase-money liens on their property. Two years later, the borrowers refinanced the mortgages with a new loan and paid off the purchase-money mortgages. The note and deed of trust securing the loan were subsequently assigned to and acquired by a new lending entity (“mortgagee”). In January 2009, the mortgagee notified the borrowers of their default and intent to accelerate the loan, and five months later, accelerated the note. Concurrently, the original lender initiated foreclosure proceedings against the borrowers despite having assigned the loan to the mortgagee, which resulted in a sale of the property. Padgett Law Group Promotes Kris Zilberstein, Esq. to Supervising Attorney of Bankruptcy Operations10/7/2020

[October 7, 2020 | Dallas, TX] Today Padgett Law Group (PLG) announced the promotion of Kris Zilberstein, Esq. to the role of Supervising Attorney of Bankruptcy Operations. Previously, Kris served the firm as a Senior Bankruptcy Attorney. She joined PLG in 2020 and has practiced in the creditors rights' space since 2009. In her new role, Kris leads PLG's docket related matters (“DRM”) in bankruptcy, also known as the practice's national unit, which include PLG’s National Attorney Network, Special Projects, and business purpose loans. In addition, Kris continues her California & Chapter 11 practice. "Kris proved to be an immediate asset to PLG with her many years of focused, specialized bankruptcy experience from Chapter 11 work to complex litigation and managing multi-jurisdictional work. As our national practice continues to grow, Kris was clearly the right fit to help the firm manage that growing piece of our business," said Managing Attorney of Bankruptcy Keena Newmark, Esq. "I am thrilled to step into this new role with PLG. My diverse experience in all facets of bankruptcy has prepared me for a national operational and legal oversight role. I am excited to start this next chapter of my career with PLG," said Kris. Kris is based out of the firm's Dallas, TX office. Kris is license in Texas, California, Colorado, Nebraska, Texas, and Washington. She can be reached at [email protected]. In a unique move, that mimics the rules of Federal Procedure, The Texas Supreme Court has made some of the biggest discovery changes to occur in Texas State trial courts in the past two decades. Attorneys and staff will need to take to learn and fully understand all the changes in order to properly implement new procedures as they apply to all cases filed on or after January 1, 2021. In accordance with the 86th legislature and Senate Bill 2342 the Texas Supreme Court has approved amendments to Rules 169 and 194 of the Texas Rules of Civil Procedure. Rule 169 governing expedited actions has been amended to apply to suits in which all claimants, other than counter-claimants, affirmatively plead that they seek only monetary relief aggregating $250,000 or less excluding interest, statutory, or punitive damages and penalties, and attorney’s fees and costs. This amendment has effectively raised the statutory limitation for expedited actions from $100,000 to $250,000. This will essentially promote the prompt, efficient, and cost-effective resolution of civil actions filed in courts of law in which the amount in controversy does not exceed $250,000. Further, certain actions will remain exempt from Rule 169’s application by statute. See e.g. Tex. Estates Code Sec. 53.107.

The most important changes to be aware of however have been made to the rules of discovery. Per the new amendments, discovery and production will no longer be optional. Effective as of January 1, 2021 Rule 194 has been amended as follows: 194.1 Duty to Disclose; Production

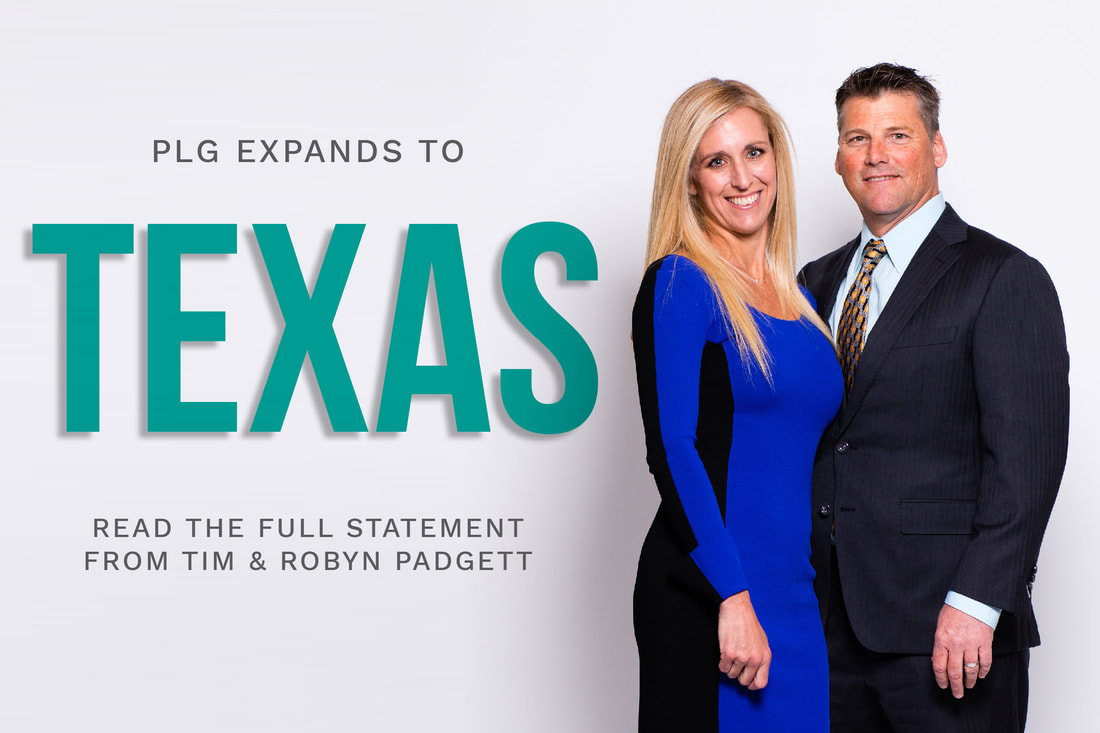

In a decision that will be deemed as a big win for creditors, litigators, or really anyone who has ever dealt with evasive defendants, the State of Texas has decided to enter into a new age and territory when it comes to dealing with service of process. The Supreme Court of Texas in accordance with the 86th Legislature and Senate Bill 891 has approved amendments to Rule 106 of the Texas Rules of Civil Procedure. Rule 106 has been revised in response to section 17.033 of the Civil Practice and Remedies Code, which calls for rules to provide for substituted service of citation by social media. With the recent decision in Federal Home Loan Mortgage Corporation v. Zepeda, No19-0712, the Texas Supreme Court issued a significant decision in favor of home equity lenders in, answering the question, “Is a lender entitled to equitable subrogation, where it failed to correct a curable constitutional defect in the loan documents under §50 of the Texas Constitution?” Or more specifically, “If the party seeking equitable subrogation could have satisfied the requirements of §50(a)(6)(Q)(ix) but failed to do so, does that failure preclude it from invoking equitable subrogation?” Today, we’re excited to announce that the firm has added the great state of Texas to our footprint which also includes Arkansas, Tennessee, Georgia, and our founding state of Florida. For 25 years Padgett Law Group (PLG) has excelled at delivering a client-first approach while offering sound legal advice and aggressive representation for our partners. We set the bar for excellence in creditors rights’ representation because we’re focused solely on building a service-driven practice that encompasses the full range of default needs for today’s creditors. Effective immediately, PLG's Texas operations and the firm's bankruptcy operations will be led by Keena Newmark, Esq., who has joined the firm as Managing Attorney of Bankruptcy Operations. The new Dallas office is also home to additional attorney hires Julian Cotton, Esq. and Mary Vitarkas, Esq. Over the coming weeks, additional Texas staff hires will be announced. Also effective immediately is the promotion of Evan S. Singer, Esq. to Managing Attorney of Default Services, a newly created firm-wide role. Evan remains based out of the firm’s Atlanta, GA office and will work closely with Keena across the firm's practices, operations, client relations, and business development efforts.

|

PLG BLOG DISCLAIMER

The information contained on this blog shall not constitute legal advice or a legal opinion. The existence of or review and/or use of this blog or any information hereon does not and is not intended to create an attorney-client relationship. Further, no information on this blog should be construed as investment advice. Independent legal and financial advice should be sought before using any information obtained from this blog. It is important to note that the cases are subject to change with future court decisions or other changes in the law. For the most up-to-date information, please contact Padgett Law Group (“PLG”). PLG shall have no liability whatsoever to any user of this blog or any information contained hereon, for any claim(s) related in any way to the use of this blog. Users hereby release and hold harmless PLG of and from any and all liability for any claim(s), whether based in contract or in tort, including, but not limited to, claims for lost profits or consequential, exemplary, incidental, indirect, special, or punitive damages arising from or related to their use of the information contained on this blog or their inability to use this blog. This Blog is provided on an "as is" basis without warranties of any kind, either express or implied, including, but not limited to, warranties of title or implied warranties of merchantability or fitness for a particular purpose. |

|

Padgett Law Group and Padgett Law Group EP are D/B/As of Timothy D. Padgett, P.A. Timothy D. Padgett, P.A.'s practice areas include creditors' rights, estate planning and probate, real estate transactions and litigation. Not all practices or services are available in all states in which Timothy D. Padgett, P.A. practices.

PRIVACY STATEMENT | WEBSITE DESIGN BY SQFT.MANAGEMENT

|