PLG NEWSNews + updates + recent press

|

Archives

June 2024

May 2024

March 2024

February 2024

August 2023

May 2023

April 2023

January 2023

November 2022

September 2022

August 2022

June 2022

April 2022

March 2022

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

October 2020

September 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

August 2019

June 2019

May 2019

April 2019

February 2019

January 2019

November 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

March 2018

January 2018

December 2017

October 2017

September 2017

August 2017

July 2017

|

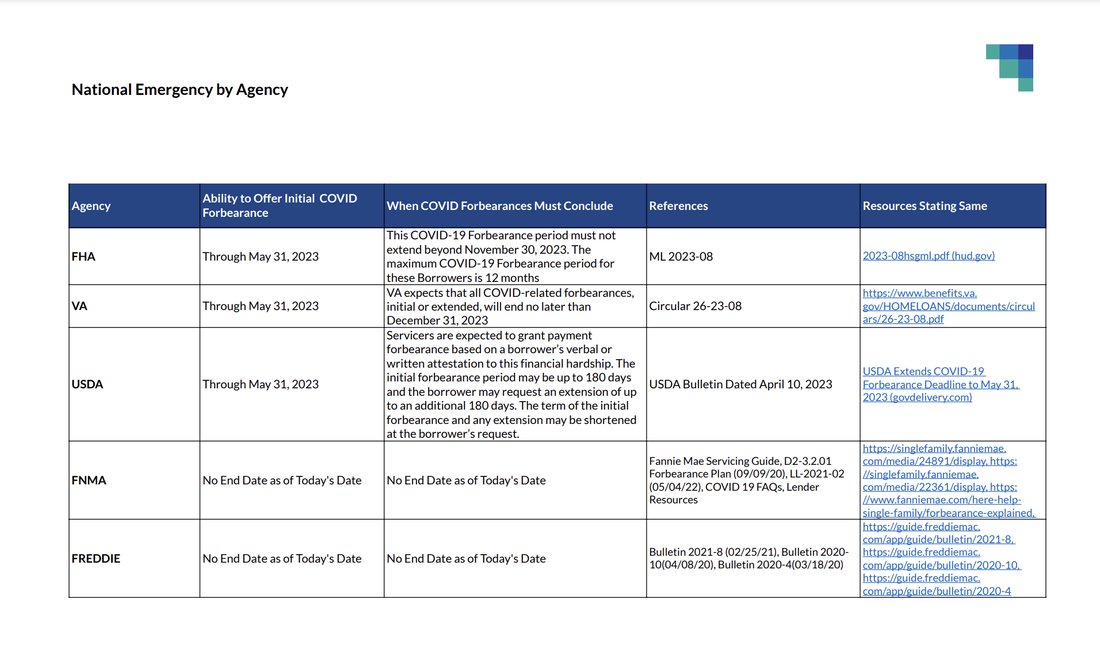

Introduced in the Senate on March 23, 2023, and referred to committee on March 29, 2023, Ohio Senate Bill 94, known in short form as the Bill that “regards the Treasurer of State, recorded instruments, liens, etc.,” sponsored by Senators Andrew O. Brenner (R) and Al Landis (R), seeks to amend numerous sections of the Ohio Revised Code related to recorded instruments, but also to enact section §5301.234, thereby codifying the doctrine of Equitable Subrogation. The legal doctrine of equitable subrogation permits one mortgagee to replace another mortgagee in lien priority and is typically claimed refinancing lenders who pay off the original mortgage and want to have the same priority as that lender. The doctrine seeks to prevent unjust enrichment and promote equity. Introduced in the Senate on January 23, 2023, and referred to committee on February 8, 2023, Ohio Senate Bill 25, known in short form as the Bill that “regards real property foreclosures,” sponsored by Senator Bob D. Hackett (R), seeks to alter the procedures for foreclosure sales. Chapter 2329 of the Ohio Revised Code currently governs execution upon judgments, including sales of real property resulting from foreclosure actions. SB25 proposes four significant changes to the foreclosure sale process that could result in a reduction in the length of time and cost of the foreclosure sale process: The United States Senate passed a resolution to end the National Emergency for COVID-19 on March 29, 2023, and the President signed it on Monday, April 10, ending the emergency earlier than May 11, 2023 as previously announced. Now that the National Emergency has ended, it is important to understand the implications for servicing, default, and loss mitigation. Below outlines the significance behind the ending of the National Emergency. This post includes Agency-specific updates covering:

Additional Loss Mitigation Resources“The Delaware County Common Pleas Court General Division is now piloting a mediation program for civil cases. Any civil case may be referred to mediation based on a party’s motion and the approval of the court. The assigned judge may also refer any civil case for mediation. Parties may suggest a mediator from the approved mediator list, but the court will make the final selection and appointment of the mediator. The court will pay the approved mediator for the actual time spent in the matter, up to 8 hours of mediation time. In the event the mediator or the parties would like to request that the court pay for additional mediation time, they may file a motion with the court prior to incurring those expenses. This program does not prevent parties from utilizing a private mediator at their own expense. In order for the mediation cost to be covered under this pilot program, the parties must file a motion, receive approval from the court, and utilize a mediator from the court-approved mediator list.” Arkansas Legislature Amends Statutory Foreclosure Act in Response to Davis v. PennyMac Decision6/4/2021

Last year we alerted our clients and partners to the Arkansas Supreme Court ruling in Davis v. PennyMac Loan Services, LLC, 2020 Ark. 180 (May 7, 2020), wherein the Court held the sale notices used by some Arkansas law firms was too vague to satisfy the requirements of the Arkansas Statutory Foreclosure Act. To initiate a statutory foreclosure, the Statutory Foreclosure Act requires the recording of a Notice of Default and Intention to Sell (“Notice”) that states “the default for which the foreclosure is made.” Ark. Code Ann. § 18-50-104(b). The notice at issue in Davis stated that “a default has been made with respect to a provision in the mortgage.” The Court found that such boilerplate language was not a specific enough description of the default to satisfy the Statutory Foreclosure Act. Fortunately, PLG’s Arkansas foreclosures were not affected by the decision since its Notice contained the language required by the Statutory Foreclosure Act. The Court’s decision, however, created a realm of uncertainty related to statutory foreclosures completed by firms using the faulty notice. The status of all such REO properties became a topic of much concern, and the industry sought to resolve these issues through the passage of legislation amending the Statutory Foreclosure Act during the 2021 Regular Session of the Arkansas General Assembly. Thus, Act 1108 emerged, which will most likely become effective on July 30, 2021, although this date could change due to peculiarities in Arkansas law. Ohio's New Statute of Limitations on Breach of Written Contracts Goes Into Effect June 16, 20215/4/2021

Senate Bill 13 was signed into law on March, 16, 2021, and effectively shortens Ohio’s statute of limitations for filing lawsuits based on breach of contract. While R.C. 2305.06 originally set forth a lengthy 15-year statute of limitations on enforcement of a contract, the statute was amended in 2012 to reduce the limitation to eight years. The 2021 amendment to Revised Code 2305.07 now further reduces the statute of limitations for breaches of written contracts from eight years to six and reduces the statute of limitations for breaches of oral contracts from six years to four years. The new law goes into effect on June 16, 2021. |

PLG BLOG DISCLAIMER

The information contained on this blog shall not constitute legal advice or a legal opinion. The existence of or review and/or use of this blog or any information hereon does not and is not intended to create an attorney-client relationship. Further, no information on this blog should be construed as investment advice. Independent legal and financial advice should be sought before using any information obtained from this blog. It is important to note that the cases are subject to change with future court decisions or other changes in the law. For the most up-to-date information, please contact Padgett Law Group (“PLG”). PLG shall have no liability whatsoever to any user of this blog or any information contained hereon, for any claim(s) related in any way to the use of this blog. Users hereby release and hold harmless PLG of and from any and all liability for any claim(s), whether based in contract or in tort, including, but not limited to, claims for lost profits or consequential, exemplary, incidental, indirect, special, or punitive damages arising from or related to their use of the information contained on this blog or their inability to use this blog. This Blog is provided on an "as is" basis without warranties of any kind, either express or implied, including, but not limited to, warranties of title or implied warranties of merchantability or fitness for a particular purpose. |

|

Padgett Law Group and Padgett Law Group EP are D/B/As of Timothy D. Padgett, P.A. Timothy D. Padgett, P.A.'s practice areas include creditors' rights, estate planning and probate, real estate transactions and litigation. Not all practices or services are available in all states in which Timothy D. Padgett, P.A. practices.

PRIVACY STATEMENT | WEBSITE DESIGN BY SQFT.MANAGEMENT

|