PLG NEWSNews + updates + recent press

|

Archives

June 2024

May 2024

March 2024

February 2024

August 2023

May 2023

April 2023

January 2023

November 2022

September 2022

August 2022

June 2022

April 2022

March 2022

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

October 2020

September 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

August 2019

June 2019

May 2019

April 2019

February 2019

January 2019

November 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

March 2018

January 2018

December 2017

October 2017

September 2017

August 2017

July 2017

|

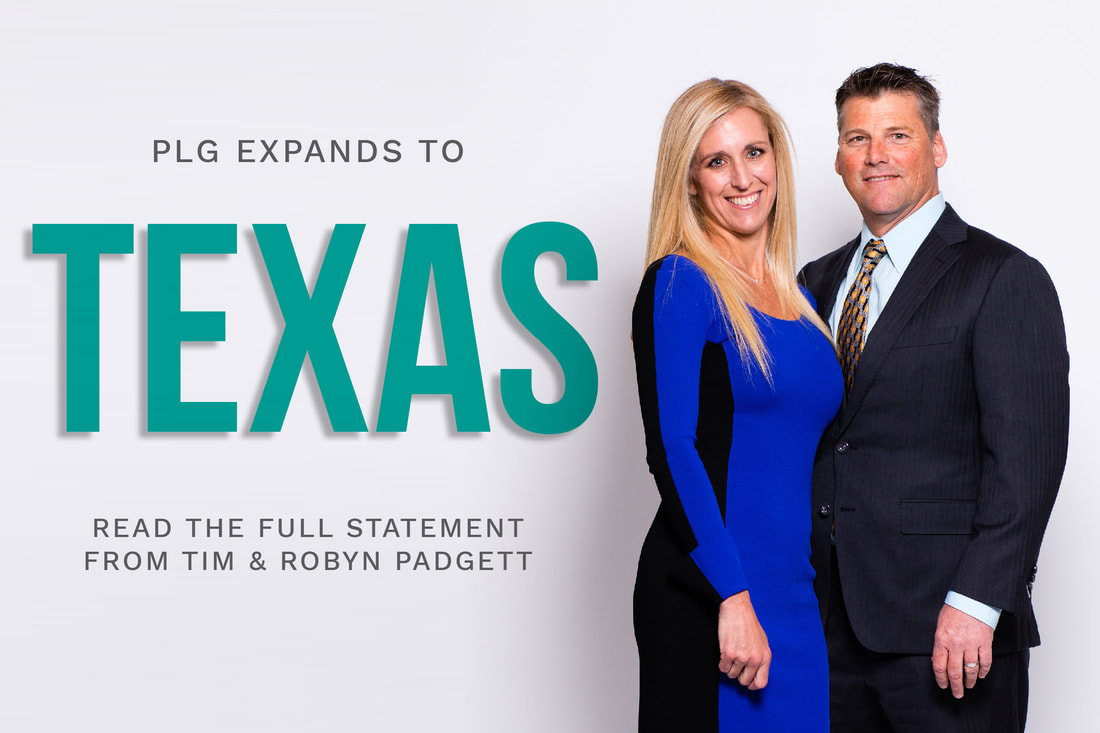

Today, we’re excited to announce that the firm has added the great state of Texas to our footprint which also includes Arkansas, Tennessee, Georgia, and our founding state of Florida. For 25 years Padgett Law Group (PLG) has excelled at delivering a client-first approach while offering sound legal advice and aggressive representation for our partners. We set the bar for excellence in creditors rights’ representation because we’re focused solely on building a service-driven practice that encompasses the full range of default needs for today’s creditors. Effective immediately, PLG's Texas operations and the firm's bankruptcy operations will be led by Keena Newmark, Esq., who has joined the firm as Managing Attorney of Bankruptcy Operations. The new Dallas office is also home to additional attorney hires Julian Cotton, Esq. and Mary Vitarkas, Esq. Over the coming weeks, additional Texas staff hires will be announced. Also effective immediately is the promotion of Evan S. Singer, Esq. to Managing Attorney of Default Services, a newly created firm-wide role. Evan remains based out of the firm’s Atlanta, GA office and will work closely with Keena across the firm's practices, operations, client relations, and business development efforts.

Effective October 1, 2018, Florida Senate Bill 220, also known as Fla. Stat. 702.12 went into effect. One of the purposes behind this law was to curb the abusive bankruptcy filings that hinder and delay foreclosure actions. Per the statute, a lienholder, in an action to foreclose a mortgage, may submit any document the defendant filed under penalty of perjury in the defendant’s bankruptcy case for use as an admission by the defendant to show a rebuttable presumption that the defendant has waived any defense to the foreclosure. The rebuttable presumption is created when a lienholder files evidence of the defendant’s intention to surrender the subject property, and a final order in the bankruptcy case which discharges the defendant’s debts or confirms the defendant’s repayment plan that provides for the surrender of the property.

This law reinforces the already favorable decisions from the bankruptcy courts in Florida that have held that a debtor who surrenders his/her property is unable to contest the foreclosure. To go further, the Eleventh Circuit has recently held that if an election of surrender is made, the debtor is unable to contest a subsequent foreclosure, even if the foreclosure has not yet occurred. In fact, the Bankruptcy Court for the Middle District of Florida found that a Chapter 13 debtor acted in bad faith by filing a Chapter 13 and seeking to treat the property when that same debtor had surrendered the property in a previous Chapter 7 and received a discharge. The Court found this to be an extension of a foreclosure defense and violated the requirements of surrender. Moving forward, it is imperative that PLG clients are being proactive in the bankruptcy cases (Chapters 7 and 13) in order to ensure that the following occur:

It is to PLG clients' advantage to obtain a declaration of surrender (even if the loan is current) in order to stop endless litigation in the foreclosure. DATE: OCTOBER 10 TIME: 2:00 - 3:00 P.M. EDTManufactured/Mobile homes present numerous challenges in the mortgage origination and default arenas. This webinar will focus on the titling/de-titling of manufactured/mobile homes in the States of Arkansas, Florida, Georgia, and Tennessee. Topics include how to perfect a security interest in a manufactured/mobile home, whether the title to the home should be surrendered and de-titled, or whether the home may remain titled as personal property. Attendees will also learn about state-specific de-title processes, bankruptcy implications, and how manufactured/mobile homes are handled in non-judicial and judicial foreclosures. There will be a ten minute Q&A session at the end of the presentation. This webinar features Mitch Berry, Esq., Supervising Attorney of PLG's Arkansas operations and Josh Hopkins, Esq., Supervising Attorney of REO & Title operations.

|

PLG BLOG DISCLAIMER

The information contained on this blog shall not constitute legal advice or a legal opinion. The existence of or review and/or use of this blog or any information hereon does not and is not intended to create an attorney-client relationship. Further, no information on this blog should be construed as investment advice. Independent legal and financial advice should be sought before using any information obtained from this blog. It is important to note that the cases are subject to change with future court decisions or other changes in the law. For the most up-to-date information, please contact Padgett Law Group (“PLG”). PLG shall have no liability whatsoever to any user of this blog or any information contained hereon, for any claim(s) related in any way to the use of this blog. Users hereby release and hold harmless PLG of and from any and all liability for any claim(s), whether based in contract or in tort, including, but not limited to, claims for lost profits or consequential, exemplary, incidental, indirect, special, or punitive damages arising from or related to their use of the information contained on this blog or their inability to use this blog. This Blog is provided on an "as is" basis without warranties of any kind, either express or implied, including, but not limited to, warranties of title or implied warranties of merchantability or fitness for a particular purpose. |

|

Padgett Law Group and Padgett Law Group EP are D/B/As of Timothy D. Padgett, P.A. Timothy D. Padgett, P.A.'s practice areas include creditors' rights, estate planning and probate, real estate transactions and litigation. Not all practices or services are available in all states in which Timothy D. Padgett, P.A. practices.

PRIVACY STATEMENT | WEBSITE DESIGN BY SQFT.MANAGEMENT

|