PLG NEWSNews + updates + recent press

|

Archives

June 2024

May 2024

March 2024

February 2024

August 2023

May 2023

April 2023

January 2023

November 2022

September 2022

August 2022

June 2022

April 2022

March 2022

September 2021

August 2021

July 2021

June 2021

May 2021

April 2021

March 2021

February 2021

January 2021

December 2020

October 2020

September 2020

August 2020

July 2020

June 2020

May 2020

April 2020

March 2020

February 2020

January 2020

December 2019

November 2019

October 2019

August 2019

June 2019

May 2019

April 2019

February 2019

January 2019

November 2018

October 2018

September 2018

August 2018

July 2018

June 2018

May 2018

March 2018

January 2018

December 2017

October 2017

September 2017

August 2017

July 2017

|

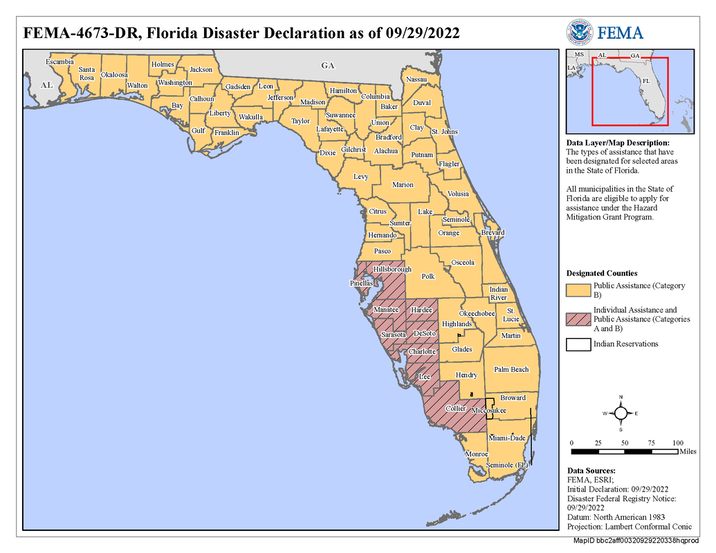

In response to Hurricane Ian, PLG has closed its Tampa, Florida office effective Wednesday, September 28 until further notice for the safety of our employees. At this time, the firm’s Florida operations remain unimpacted and general business continues uninterrupted via our office in Tallahassee and remote work authorization for potentially impacted employees. PLG's servers are protected, operational, and data redundant per our Business Continuity Plan. At this time, the firm anticipates remaining fully operational and available for client interfacing with little to no impact on day-to-day operations. PLG is also monitoring court closures in response to the hurricane and will update clients as needed regarding rescheduled hearings, trials, sales, and other delays related to the impact of Hurricane Ian. Click here to see a list of current closures provided by our vendor Provest. Everyone impacted and those in the path of Hurricane Ian are in our thoughts and prayers. UPDATED INFORMATION UPDATED INFORMATION White House Disaster Declaration“Today, President Joseph R. Biden, Jr. declared that a major disaster exists in the State of Florida and ordered Federal aid to supplement State, tribal, and local recovery efforts in the areas affected by Hurricane Ian beginning on September 23, 2022, and continuing. The President’s action makes Federal funding available to affected individuals in the counties of Charlotte, Collier, DeSoto, Hardee, Hillsborough, Lee, Manatee, Pinellas, and Sarasota. Assistance can include grants for temporary housing and home repairs, low-cost loans to cover uninsured property losses, and other programs to help individuals and business owners recover from the effects of the disaster.” White House Disaster Declaration President Joseph R. Biden, Jr. Approves Florida Disaster Declaration - The White House UPDATED INFORMATION Freddie Mac Release"Freddie Mac today reminded homeowners and mortgage servicers of its immediate relief options for those who may be affected by Hurricane Ian. Freddie Mac’s short-term forbearance program provides homeowners mortgage relief for up to 12 months without incurring late fees or penalties. When they are back on their feet, homeowners have several options to make up the missed payments, including additional forbearance, if needed.

Freddie Mac Reminds Homeowners in the Path of Hurricane Ian of Immediate Mortgage Relief Options: Freddie Mac Reminds Homeowners in the Path of Hurricane Ian of Immediate Mortgage Relief Options | Freddie Mac (gcs-web.com) UPDATED INFORMATION Fannie Mae ReleaseFannie Mae is reminding homeowners and renters that have been or may be impacted by a natural disaster, including those affected by Hurricane Ian in Florida and other southeastern states, of available mortgage assistance and disaster relief options. Under Fannie Mae’s guidelines for single-family mortgages impacted by a natural disaster: Homeowners may request mortgage assistance by contacting their mortgage servicer (the company listed on their mortgage statement) following a disaster. Mortgage servicers are authorized to offer a forbearance plan for up to 90 days – even without establishing contact with the homeowner – if the servicer believes the home was affected by the disaster. Homeowners affected by a disaster are often eligible to reduce or suspend their mortgage payments for up to 12 months. During this temporary reduction or pause in payments, homeowners will not incur late fees and foreclosure and other legal proceedings are suspended. Following a forbearance plan, there are a number of options available to potentially help homeowners catch up on missed payments, including Disaster Payment Deferral. In addition, homeowners currently on a COVID-19-related forbearance plan who were subsequently impacted by a natural disaster may still be eligible for assistance and should contact their mortgage servicer to discuss options.” Fannie Mae Reminds Homeowners, Renters, and Mortgage Servicers of Disaster Relief Options for Those Affected by Hurricane Ian: Fannie Mae Reminds Homeowners, Renters, and Mortgage Servicers of Disaster Relief Options for Those Affected by Hurricane Ian | Fannie Mae UPDATED INFORMATION VA Insured Loans, VA Servicer Handbook M26-4, Chapter 21, DisastersPer the VA Handbook, "This chapter addresses Department of Veterans Affairs (VA) guaranteed home loans affected by a Federal Emergency Management Agency (FEMA) disaster such as flooding, tornado, storms, etc., including ecological, or other human-made disasters, and provides guidance on what actions should be taken to assist the affected borrowers. Affected borrowers are considered those borrowers whose homes were damaged, or destroyed, the families of those impacted, those who suffered considerable personal injury, those who provide assistance to impacted family members, and those whose work environments were destroyed, severely damaged, or compromised as a result of the disaster. Servicers must check with FEMA to obtain the specific counties included in the federally-declared disaster area, and corresponding declaration dates, along with any amendments to the declaration, at www.fema.gov/disasters. Any VA loan which closed prior to the date of the declared disaster is eligible for VA loss mitigation options. Please see Title 38, Code of Federal Regulations (C.F.R.), section 36.4329 (Hazard Insurance), regarding insurance coverage for properties which may have been damaged, or destroyed by the disaster. 21.02 BORROWER ASSISTANCE a. VA encourages servicers of guaranteed loans to extend all available options to borrowers in distress as a result of a disaster. Responsible counseling with borrowers should help determine whether the delinquency is related to a disaster, or whether it stems from other sources that must be addressed. The proper use of authorities granted in VA regulations may be of assistance in appropriate cases. For example, 38 C.F.R. 36.4311 (Prepayments), allows the reapplication of prepayments to cure, or prevent a default. This means that if a borrower has made enough additional pre-payments, the pre-payments may be reversed, the principal balance increased up to the scheduled balance, and then pre-payments may be re-applied as regular installments. Also, 38 C.F.R. 36.4315 (loan modifications), allows the terms of any guaranteed loan to be modified without the prior approval of VA, provided certain conditions in the regulation are satisfied. b. Members of the National Guard may be called to active duty to assist in recovery efforts. VA encourages servicers to extend special forbearance to National Guard members who experience financial difficulties as a result of their service. 21.03 MORATORIUM ON FORECLOSURE a. Although the loan servicer is ultimately responsible for determining when to initiate foreclosure, and complete a termination action, VA requests that servicers establish a 90-day moratorium from the date of a disaster on initiating new referrals to foreclosure on affected loans. VA regulation 38 C.F.R. 36.4324(a)(3)(ii) allows additional interest on a guaranty claim when termination has been delayed due to circumstances beyond the control of the servicer, such as VA-requested forbearance. The servicer should notify the VA-assigned technician of forbearance due to a disaster so the technician can identify that loan in the VA Loan Electronic Reporting Interface (VALERI) to ensure interest is adjusted accordingly. Any questions about impact should be discussed with the VA- assigned technician. b. When a loan becomes 61 days delinquent, and the delinquency is due to the disaster, servicers should use the Reason for Default of “Casualty Loss.” Inspections should be completed, per VA requirements, prior to day 60 of delinquency. 21.04 VA CONVEYANCE AFTER DISASTER The Transfer of Custody (TOC) event must be submitted to VA within 15-days of loan termination. If a disaster occurs prior to VA accepting the TOC, the servicer is required to obtain a new appraisal to reflect the current value of the property, so that any damages due to the disaster can be taken into consideration. Servicers are also required to take appropriate action in filing an insurance claim, and must advise VA of the amount received in insurance loss proceeds, if any. 21.05 VA DISASTER LOAN MODIFICATION a. There are two modification options for borrowers who have been impacted by a federally-declared disaster, the VA Disaster Loan Modification and the Disaster Extend Modification. The modifications allow servicers to extend payment relief to impacted delinquent borrowers when the borrower has not submitted a complete loss mitigation application. All impacted borrowers should have an opportunity to be considered for a VA Disaster Loan Modification as long as eligibility requirements are met. b. Refer to Chapter 5 of this handbook for more information on the disaster loan modification programs and eligibility requirements." VA Servicer Handbook M26-4, Chapter 21, Disasters: Access The relevant chapter of the VA Handbook PDF Additional VA Resources VA Guidance on Natural Disasters UPDATED INFORMATION FHA INSURED LOANS SINGLE FAMILY HANDBOOK 4000.1 Presidentially Declared Major Disaster AreasPer the FHA Handbook, “under the Robert T. Stafford Disaster Relief and Emergency Assistance Act, the President has authority to declare a major disaster for any area which has been affected by damage of sufficient severity and magnitude to warrant major disaster assistance. Disaster declarations and information regarding available federal assistance for each disaster incident are posted on the Federal Emergency Management Agency’s (FEMA) website. Whenever the President declares a major disaster, the Mortgagee must implement the procedures set forth in this section for each designated area that is eligible for federal disaster assistance, designated for public assistance, individual assistance, or both, unless otherwise specified.

i. Moratorium on Foreclosures (A) Standard FHA-insured Mortgages secured by Properties located in a PDMDA will be subject to a moratorium on foreclosures following the disaster declaration. The foreclosure moratorium is:

(B) Required Documentation: The Mortgagee must retain in the Servicing File and the Claim Review File, if applicable, any approved extensions from HUD related to a foreclosure moratorium. (C) Hazard or Flood Insurance Settlement: The Mortgagee must take no action to initiate or complete foreclosure proceedings, after expiration of a disaster-related foreclosure moratorium, if such action will jeopardize the full recovery of a hazard or flood insurance settlement. Loss Mitigation for Borrowers in PDMDAs: Should Presidentially-Declared Major Disasters adversely impact a Borrower’s ability to make on-time Mortgage Payments, the Mortgagee must provide the Borrower with forbearance and HUD loss mitigation assistance, where appropriate, as provided in applicable FHA policy guidance. Borrowers Impacted by a PDMDA and COVID-19 For Borrowers impacted by a PDMDA during the COVID-19 pandemic:

FHA Single Family Housing Handbook 4000.1 Relevant FHA Handbook Section Comments are closed.

|

PLG BLOG DISCLAIMER

The information contained on this blog shall not constitute legal advice or a legal opinion. The existence of or review and/or use of this blog or any information hereon does not and is not intended to create an attorney-client relationship. Further, no information on this blog should be construed as investment advice. Independent legal and financial advice should be sought before using any information obtained from this blog. It is important to note that the cases are subject to change with future court decisions or other changes in the law. For the most up-to-date information, please contact Padgett Law Group (“PLG”). PLG shall have no liability whatsoever to any user of this blog or any information contained hereon, for any claim(s) related in any way to the use of this blog. Users hereby release and hold harmless PLG of and from any and all liability for any claim(s), whether based in contract or in tort, including, but not limited to, claims for lost profits or consequential, exemplary, incidental, indirect, special, or punitive damages arising from or related to their use of the information contained on this blog or their inability to use this blog. This Blog is provided on an "as is" basis without warranties of any kind, either express or implied, including, but not limited to, warranties of title or implied warranties of merchantability or fitness for a particular purpose. |

|

Padgett Law Group and Padgett Law Group EP are D/B/As of Timothy D. Padgett, P.A. Timothy D. Padgett, P.A.'s practice areas include creditors' rights, estate planning and probate, real estate transactions and litigation. Not all practices or services are available in all states in which Timothy D. Padgett, P.A. practices.

PRIVACY STATEMENT | WEBSITE DESIGN BY SQFT.MANAGEMENT

|